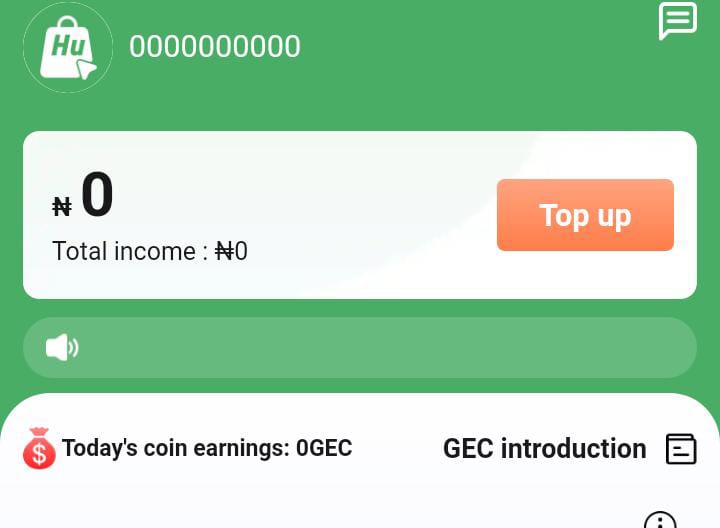

Hugevers.com Sign up | Earn 5k Daily Here

Are you looking for legit online paying sites to make money in your home. Hugevers.com is a newly launched platform, that works by performing tasks on their app. Here is everything you need to know about Hugevers paying site, withdrawal process, reviews, and Hugevers.com signup works. What is hugevers.com? Hugevers is an app that works by … Read more