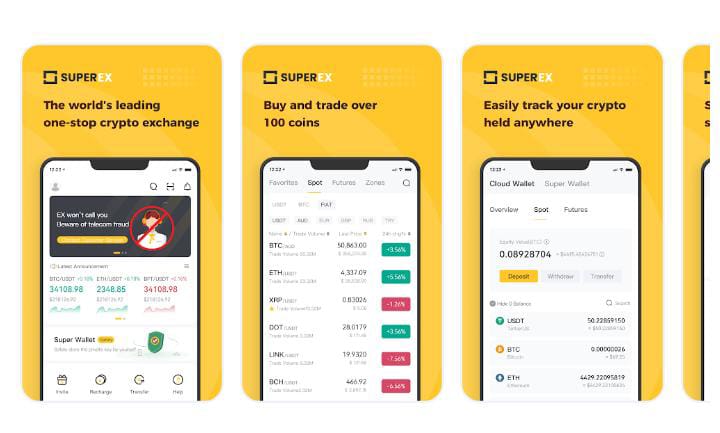

Superex Exchange App download | Claim $10 airdrop | contract address

Similar to Coinbase, Binance, Houbi, KuCoin, and other popular cryptocurrency exchanges, SuperEx exchange is a well-known cryptocurrency exchange worldwide with an opportunity to claim airdrop worth $10 when you download Superex exchange app as a new user. What is superex exchange? The SuperEx App is a cryptocurrency exchange platform that enables users to purchase and … Read more